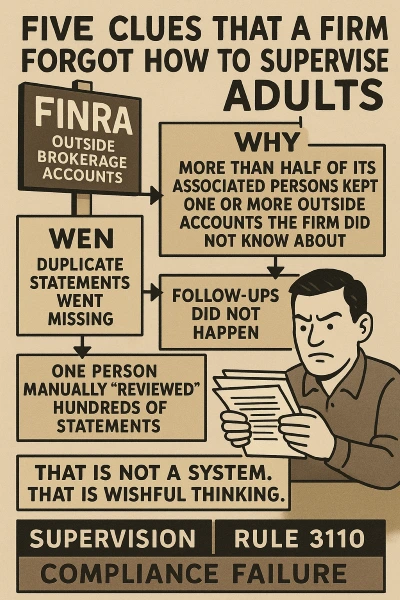

Let’s play the game of “What The hell is happening Here”. FINRA, Rule 3110, monitoring, noncompliance, and outside brokerage accounts. Five indicators that a company has forgotten how to manage grownups. The company pledged to implement fundamental controls. Why. Over 50% of its associates maintained one or more external accounts that the company was unaware of. Duplicate statements went missing. Follow-ups did not happen. One person manually “reviewed” hundreds of statements. That is not a system but more like wishful thinking and compliance failure at its worst.

This is not exotic misconduct. It is page one of supervision. Require prior written consent for outside accounts. Reconcile disclosures to actual statements. Investigate trading against the watch list. Document the checks. Then make sure more than one human can do the job without a cape.

How busy you are does not matter to regulators. You cannot oversee it, if your representatives deal outside (outside brokerage accounts) the company and you are blind to it. You’ll get a bill and a public order when that gap meets insider trading surveillance or conflict checks.

Takeaway: Stop calling it an “administrative” miss. Build a real process. Automated feeds. Reconciliations. Exception reports. timestamps for escalations. You will make headlines if you rely on heroics. The type you would rather not have and a bill due immediately. FINRA Rule 3110 will get you again.